Best Payment Apps USA in 2026

Riten Debnath

23 Sep, 2025

In 2026, paying for everything from morning coffee to monthly bills is easier than ever thanks to powerful payment apps designed for speed, security, and convenience. Whether you’re sending money to friends, shopping online, or managing business transactions, the right payment app gives you control in seconds without the hassle of cash or cards. With innovation booming in digital wallets, peer-to-peer transfers, and integrated financial services, keeping up is key to staying ahead.

I’m Riten, founder of Fueler, a platform that helps freelancers and professionals get hired through their work samples. In this article, I’ve walked you through the most in-demand freelance skills for 2026. But beyond mastering skills, the key is presenting your work smartly. Your portfolio isn’t just a collection of projects, it’s your proof of skill, your credibility, and your shortcut to trust.

1. Apple Pay

Apple Pay stands out as the best payment app for users deeply rooted in the Apple ecosystem. It transforms your iPhone, Apple Watch, or Mac into a digital wallet that works everywhere from stores to apps to websites without exposing your card details. Security is built-in with biometric authentication and tokenization, keeping your spending safe and private.

- Contactless payments: Quickly tap your device at NFC-enabled terminals.

- In-app and web payments: Pay without typing card info.

- Peer-to-peer transfers: Send and receive money easily via iMessage.

- Privacy-focused: No card numbers are stored on your device or shared with merchants.

- Pricing: Free to use; standard credit/debit card fees apply.

Why it matters: For iPhone and Apple users, Apple Pay is the seamless way to pay everywhere combining convenience with privacy, which is crucial for digital payments in 2026.

2. Google Wallet

Google Wallet is the go-to digital wallet for Android users in the USA. It offers a smooth, all-in-one platform to store payment cards, loyalty cards, tickets, and more. With tap-to-pay and easy access to Google Pay services, it’s built for fast, secure checkout whether you’re in-store or online.

- Digital wallet: Holds debit, credit, and loyalty cards.

- Tap-to-pay: Uses NFC technology for contactless payments.

- Ticket & ID storage: Safely stores boarding passes, event tickets, and student IDs.

- Integration: Works with other Google apps and services.

- Pricing: Free; standard card processing fees apply.

Why it matters: Android’s dominant market share means Google Wallet offers broad compatibility, making mobile payments frictionless for millions nationwide.

3. Cash App

Cash App has evolved from simple peer-to-peer payments to a full financial ecosystem. Beyond sending money instantly to friends, users can buy stocks, trade Bitcoin, and receive direct deposits all in one app. Its simple design appeals especially to younger users looking for financial versatility.

- Instant P2P payments: Send money using email, phone, or $Cashtag.

- Cash Card: A physical debit card linked to your app balance.

- Investments: Buy fractional stocks and Bitcoin seamlessly.

- Direct deposit: Get paychecks straight into your Cash App.

- Pricing: Free for most services; instant transfers cost 1.5% fee.

Why it matters: Cash App combines payments, investing, and banking features, giving users comprehensive financial control at their fingertips in 2026.

4. PayPal

PayPal remains the leader in safe, global online payments with millions of active users worldwide. It offers buyer and seller protection that makes it a preferred choice for eCommerce and cross-border transactions. PayPal’s extensive network means virtually every online merchant accepts it, and many sellers rely on a PayPal fee calculator to quickly understand how processing fees affect their actual take-home amount before pricing products or services.

- Global payments: Send and receive money worldwide with ease.

- Buyer protection: Ensures safe transactions and dispute resolution.

- Credit & BNPL: Pay later options and credit services integrated.

- Business tools: Invoicing, subscriptions, and payment gateway services.

- Pricing: Free for personal payments in the US; merchants pay 2.29% + $0.30 per transaction.

Why it matters: PayPal’s reliability and security continue to make it indispensable for online purchases and business payments in a globalized economy.

5. Venmo

Venmo shines among younger, social-savvy users with its blend of easy peer-to-peer payments and social engagement. You can send money instantly to friends with emojis and comments, making everyday transactions fun and interactive. Venmo also offers a physical debit card accepted nationwide.

- Social payments: Share payment activity with friends and emoji reactions.

- Venmo Card: Spend your balance anywhere Mastercard is accepted.

- Direct deposit: Receive paychecks directly into your app.

- Bill splitting: Manage group expenses hassle-free.

- Pricing: Free for standard transfers; 1.75% fee for instant transfers.

Why it matters: Venmo turns money transfers into a social experience, appealing especially to Gen Z and millennials who want more than basic payments.

Fueler: Showcase Your Skills and Financial Fluency

In today’s job market, demonstrating your skills isn’t just about what you say it’s about showing proof. Whether you work in fintech, digital marketing, or finance, Fueler lets you create a professional portfolio filled with real projects, case studies, and payment integrations you’ve mastered. Sharing your expertise through results like app builds, campaign analytics, or financial models helps you build trust and stand out to clients and employers.

Final Thoughts

Choosing the right payment app depends on your lifestyle, device preference, and the features you use most. In 2026, top apps combine speed, security, and versatility to make handling money effortless. Whether you want a simple tap-to-pay experience, integrated investing tools, or social payments with friends, there’s an app tailored for you. Staying current with these trends not only simplifies your finances but also opens doors if you work in or around fintech services.

FAQs

1. What are the best payment apps for USA users in 2026?

Apple Pay, Google Wallet, Cash App, PayPal, and Venmo lead the pack with diverse features, security, and ease of use.

2. Are payment apps free to use?

Most apps are free for basic transfers, but may charge fees for instant transfers, currency exchange, or merchant transactions.

3. Which payment app is best for Apple users?

Apple Pay is the most seamless and secure choice due to its deep device integration and strong privacy protections.

4. Can I use payment apps for international transfers?

Yes, apps like PayPal and Cash App support international transfers, though fees and exchange rates may apply.

5. How do payment apps ensure security?

They use encryption, tokenization, biometric authentication, and fraud monitoring to protect users’ financial data and transactions.

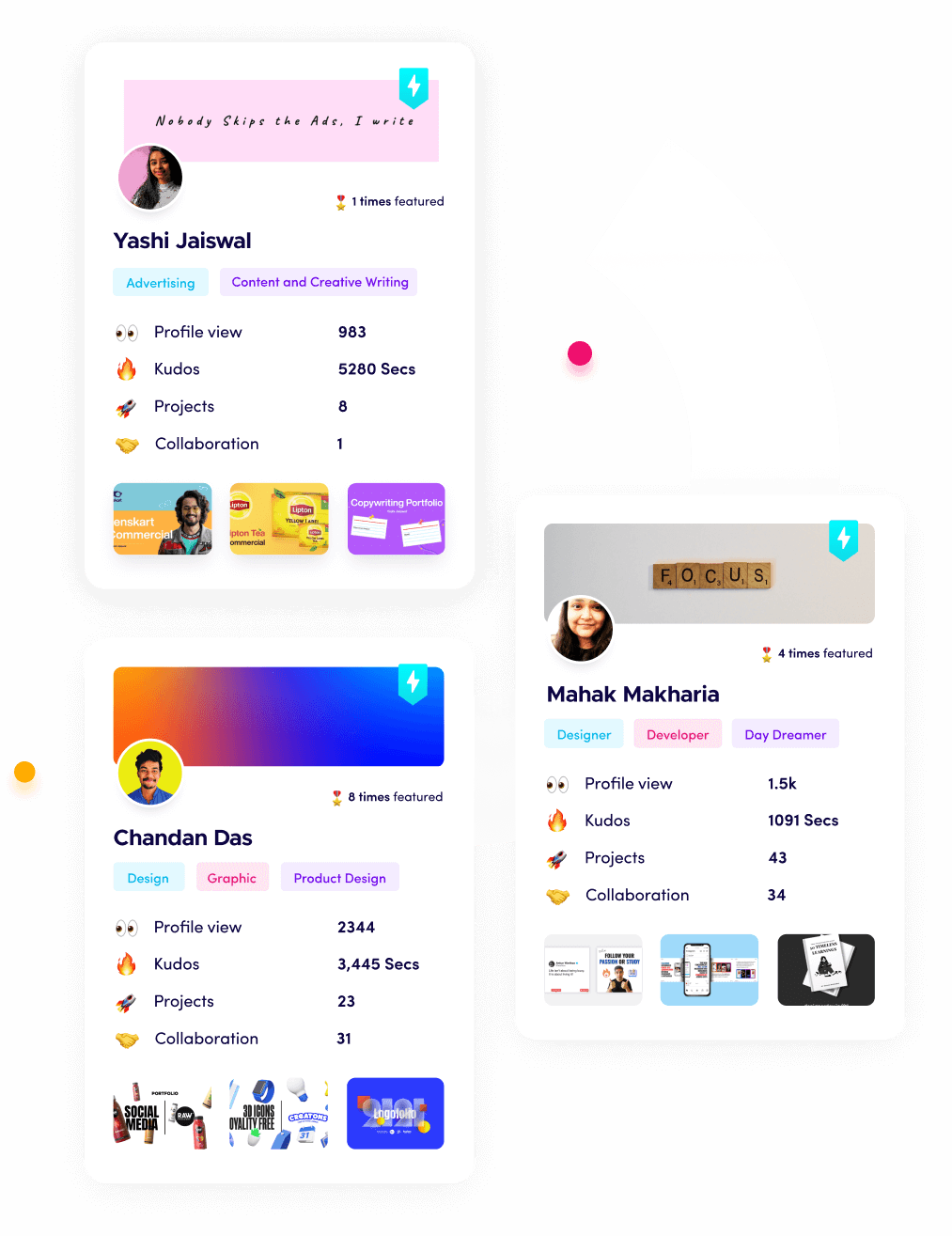

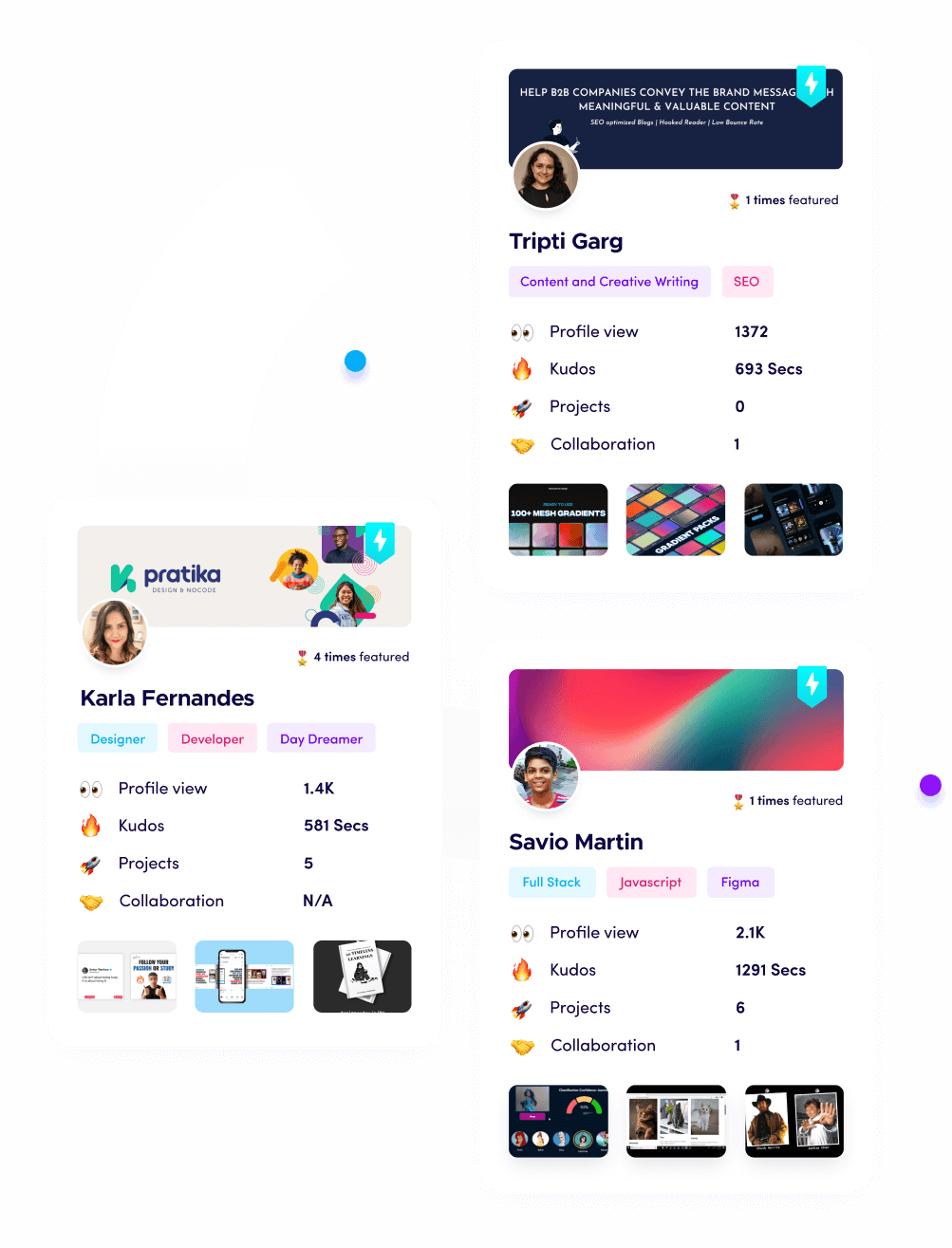

What is Fueler Portfolio?

Fueler is a career portfolio platform that helps companies find the best talents for their organization based on their proof of work. You can create your portfolio on Fueler, thousands of freelancers around the world use Fueler to create their professional-looking portfolios and become financially independent. Discover inspiration for your portfolio

Sign up for free on Fueler or get in touch to learn more.