How US Agencies Can Automate Payments Fast

Riten Debnath

12 Sep, 2025

Imagine a world where US federal agencies no longer spend weeks or months processing payments manually but can send funds instantly, securely, and fully electronically. With the 2025 federal mandate to end paper checks and switch to digital payments, the urgency for fast, reliable payment automation has never been greater. Agencies equipped with modern, automated systems reduce costs, speed up payments to millions of recipients, and minimize fraud risks dramatically.

I’m Riten, founder of Fueler, a platform that helps freelancers and professionals get hired through their work samples. In this article, I’ve walked you through the most in-demand freelance skills for 2025. But beyond mastering skills, the key is presenting your work smartly. Your portfolio isn’t just a collection of projects, it's your proof of skill, your credibility, and your shortcut to trust.

Why Automating Payments Is Crucial for US Agencies Today

US federal agencies process trillions annually and have relied heavily on paper checks—a costly, slow, and fraud-prone system. A landmark 2025 executive order mandates eliminating paper checks for all federal payments by September 30, 2025. This is a major shift to enhance efficiency, reduce operational costs, and combat payment fraud across departments.

- Automating payments enables agencies to disburse funds faster to vendors, contractors, and citizens receiving benefits.

- Fully electronic systems, such as the Automated Standard Application for Payments (ASAP), facilitate instant, secure money transfers without manual paperwork.

- Integration with Treasury platforms consolidates payment processes, ensuring compliance with federal financial regulations.

- Automating payments frees agency staff from repetitive tasks, allowing them to focus more on mission-critical activities.

Why it matters: Transitioning to automated payments ensures agencies meet federal compliance deadlines, eliminates wasted resources on paper processing, and improves payment transparency and security.

Essential Tools US Agencies Use to Automate Payments

1. Automated Standard Application for Payments (ASAP)

ASAP is a fully electronic platform tailored for federal agencies to transfer funds quickly and securely to grant recipients, contractors, and other organizations.

- Enables easy creation and management of payment recipient accounts online, removing paper hassles.

- Allows recipients to request payments electronically, eliminating manual paperwork.

- Supports multiple fast payment methods, including Fedwire for instant transfers and ACH for same or next-day payments.

- Provides real-time reports on payment status and balances for both agencies and recipients.

Pricing: Free for federal agencies and all recipients.

Why it matters: ASAP meets stringent federal standards for payment speed, security, and compliance, greatly cutting administrative burdens while making funds available faster.

2. Payment Automation Manager (PAM)

PAM is the Treasury Department’s system that manages most federal bill payments in a highly automated and reliable manner.

- Processes over a billion payments annually, replacing older, manual systems.

- Offers centralized controls, audit trails, and reporting for improved payment oversight.

- Supports agency-specific rules and approvals for secure, compliant payments.

- Enhances accuracy and reduces the risk of payment errors.

Why it matters: PAM’s automation reduces manual work, accelerates payments, and strengthens accountability over government funds.

3. Direct Deposit and Prepaid Debit Cards

Given many recipients lack traditional bank accounts, agencies use multiple electronic payout methods to boost inclusion.

- Direct deposit remains the fastest, most reliable way to electronically disburse funds to bank accounts.

- Prepaid debit cards provide an alternative for the unbanked or underbanked population, helping ensure access to benefits or refunds.

- Both methods reduce risks associated with lost or stolen paper checks.

- Agencies can load cards remotely and provide instant electronic access to funds.

Why it matters: Offering these options maximizes usability and security across diverse populations, ensuring government payments reach all recipients efficiently.

4. Real-Time Payment Systems and Digital Wallets

Modern technology enables federal agencies to make near-instant payments securely using real-time rails and mobile wallets.

- FedNow and similar systems allow instant, 24/7/365 interbank transfers between agencies and recipients.

- Digital wallets (e.g., Pay.gov wallets, mobile apps) increase payment convenience and transparency.

- Real-time payments reduce delays, speed reconciliation, and enhance tracking.

- Notifications alert payers and recipients immediately about payment statuses.

Why it matters: Real-time payments match today’s expectations for speed and ease, enhancing satisfaction and operational effectiveness for government programs.

If you are a freelancer or professional involved in automating payments for US agencies or building digital payment systems, Fueler helps you showcase your projects and technical expertise. By demonstrating your contribution to payment modernization through real assignments and live demos in your portfolio, you gain credibility and attract clients looking for proven skills in government payment automation.

Final Thoughts

Payment automation is no longer optional for US agencies but a federal obligation by 2025. Tools like ASAP and PAM offer tested, secure platforms to speed up payments and reduce costs. Embracing direct deposit, prepaid cards, and real-time payments ensures inclusive, immediate fund access for all recipients. As digital wallets and newer technologies evolve, agencies must keep pace to meet regulatory deadlines and serve citizens better. Whether you’re a developer or consultant, showcasing your expertise in these payment systems on platforms like Fueler can open valuable opportunities.

FAQs

1. How can US federal agencies automate payments quickly in 2025?

By using platforms like ASAP and Payment Automation Manager (PAM), agencies transition from paper checks to digital payments efficiently, complying with federal rules.

2. What options exist for paying unbanked recipients in government programs?

Direct deposit and prepaid debit cards provide safe, quick options for those without traditional bank accounts.

3. How do real-time payment systems benefit US agencies and their recipients?

They provide instant fund transfers, improve cash flow management, and enable 24/7 payment processing with immediate notifications.

4. What challenges do US agencies face in eliminating paper checks?

Challenges include upgrading IT systems, retraining staff, coordinating with banks and fintechs, and ensuring accessibility for all populations.

5. How does Fueler help professionals working on government payment automation?

Fueler lets professionals showcase live projects, demos, and integrations, proving expertise and building trust with potential clients in government modernization efforts.

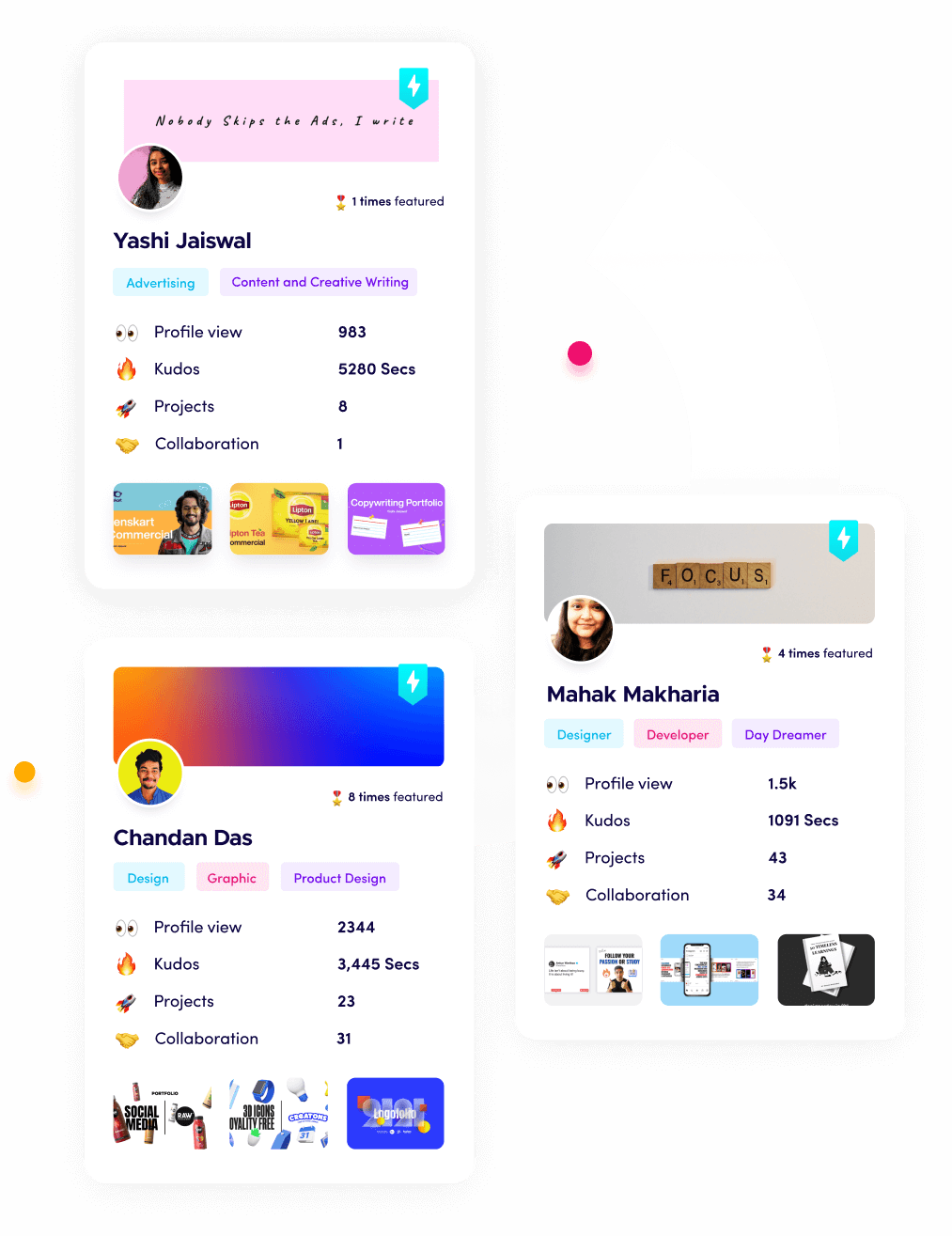

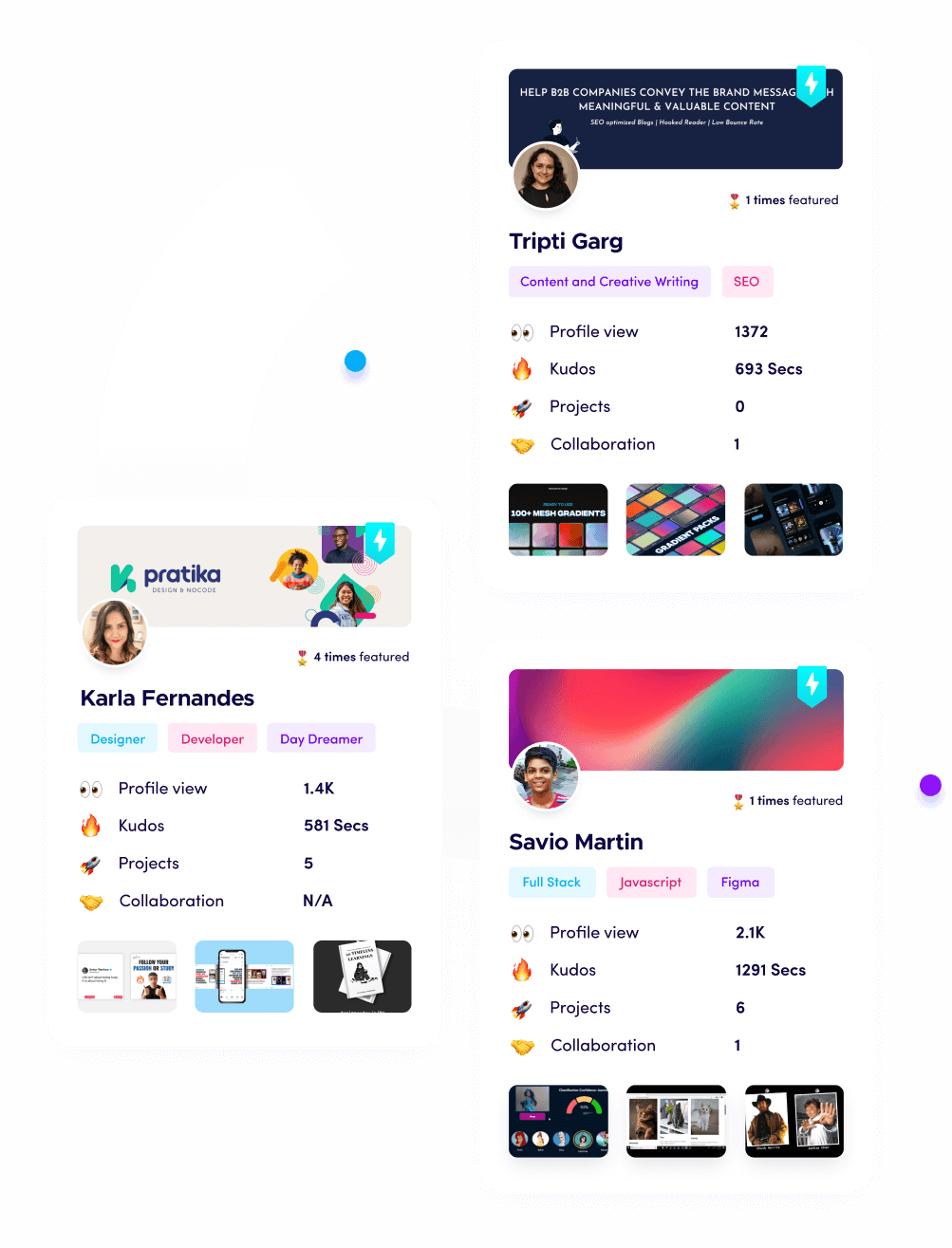

What is Fueler Portfolio?

Fueler is a career portfolio platform that helps companies find the best talents for their organization based on their proof of work. You can create your portfolio on Fueler, thousands of freelancers around the world use Fueler to create their professional-looking portfolios and become financially independent. Discover inspiration for your portfolio

Sign up for free on Fueler or get in touch to learn more.