10 Payment Trends Every Business Must Know in 2026

Riten Debnath

12 Sep, 2025

Imagine running a business where every transaction is secure, fast, and effortless for your customers. In 2026, payment technology is evolving rapidly, and staying updated on the latest trends is essential not just to survive but to thrive. Businesses that adapt early unlock better cash flow, reduce fraud, and deliver seamless experiences that win loyal customers.

I’m Riten, founder of Fueler, a platform that helps freelancers and professionals get hired through their work samples. In this article, I’ve walked you through the most in-demand freelance skills for 2026. But beyond mastering skills, the key is presenting your work smartly. Your portfolio isn’t just a collection of projects, it’s your proof of skill, your credibility, and your shortcut to trust.

1. Real-Time Payments Become the New Standard

Processing payments instantly through real-time rails is now a competitive necessity across industries. Businesses can send or receive funds instantly, any time of day, without waiting for traditional banking hours. This boosts liquidity and improves vendor and customer satisfaction, while also streamlining reconciliation and financial forecasting.

- Speeds up vendor payouts, bill payments, and refunds.

- Enables 24/7/365 transactions beyond legacy banking schedules.

- Reduces payment delays and supports just-in-time cash management.

- Improves transparency with instant payment notifications.

Why it matters: Faster payments improve cash flow and strengthen relationships with stakeholders, helping businesses scale with confidence.

2. Automation and AI Streamline Accounts Payable

Automation increasingly handles invoice processing and payment approvals with minimal human intervention. AI-powered tools in AP automation software extract data from invoices accurately, match it to purchase orders, and flag discrepancies automatically. Workflow automation speeds approval cycles and enforces compliance checks seamlessly.

- AI-based Optical Character Recognition (OCR) converts paper or PDF invoices into digital data.

- Automated matching reduces errors in billing or duplicate payments.

- Compliance and tax validations happen without slowing processes.

- Alerts and dashboards keep finance teams informed in real time.

Why it matters: Automation cuts costs, accelerates payments, and reduces compliance risks while freeing teams for higher-value tasks.

3. Digital Wallets and Mobile Payments Gain Dominance

Consumers and businesses alike prefer fast, contactless payment methods using smartphones and wearables. Digital wallets are integrated into apps and websites, offering convenient, secure transactions combined with loyalty rewards or installments.

- Apple Pay, Google Pay, Samsung Pay, PayPal, and others grow rapidly across all demographics.

- Mobile payments reduce friction at checkout, increasing conversion rates.

- Payment data can link to rewards or personalized offers for better engagement.

- Integration with QR codes or NFC technology is becoming widespread.

Why it matters: Offering multiple wallet options meets customer expectations today and future-proofs your payment acceptance.

4. Buy Now, Pay Later (BNPL) Expands Beyond Retail

BNPL solutions provide flexible payment plans to customers without traditional credit checks. Initially popular in retail, BNPL is spreading to services and B2B sectors, offering businesses tools to boost average order values and attract younger buyers.

- Accelerates conversion by lowering upfront cost barriers.

- Merchants benefit from upfront payment while offering customer convenience.

- Seamless checkout integration reduces cart abandonment.

- Popular BNPL providers include Affirm, Klarna, and PayPal’s own BNPL service.

Why it matters: Flexible financing options open new market segments, driving revenue growth across industries.

5. Blockchain and Cryptocurrency Payments Gain Traction

Though still emerging, cryptocurrency and blockchain-based payments offer benefits of transparency, low fees, and borderless capabilities. Some forward-looking businesses now accept Bitcoin, Ethereum, and stablecoins to appeal to tech-savvy customers and future-proof their payment systems. To make informed decisions, many users check an XRP calculator to track current values and conversions.

- Blockchain allows transparent, immutable transaction records.

- Crypto payments reduce reliance on traditional banking and currency fluctuations.

- Security is enhanced by cryptographic protections.

- Regulatory frameworks are evolving to encourage safe crypto adoption.

Why it matters: Early adopters position their brands as innovators and capture emerging customer bases.

6. Strengthened Payment Security and Fraud Prevention

As digital transactions rise, so do sophisticated cyber threats. Payments security employs multiple layers, including biometric authentication, tokenization, encryption, AI threat detection, and stricter compliance standards. Advanced platforms like frogo ai utilize machine learning algorithms to analyze transaction patterns across multiple data points, enabling businesses to identify and prevent fraudulent activities before they impact revenue or customer trust. Effective failed payment recovery ensures that legitimate transactions are completed without compromising security. Effective failed payment recovery ensures that legitimate transactions are completed without compromising security.

- AI detects unusual patterns and stops fraud in real time.

- Multi-factor and biometric authentication reduce identity theft.

- EMV chip and contactless cards reduce counterfeit fraud.

- Tokenization ensures sensitive data is never stored or transmitted in raw form.

Why it matters: Strong security maintains customer trust, prevents financial losses, and protects brand reputation.

7. Omnichannel Payments Integration Becomes Essential

Customers expect to move seamlessly between online, in-store, and mobile channels while retaining their preferred payment methods and loyalty perks. Businesses integrate payment systems across platforms to unify reporting, marketing, and customer experiences.

- Unified payment processing simplifies accounting and reduces errors.

- Customers enjoy consistent checkout flow regardless of channel.

- Data integration allows personalized marketing across interactions.

- Improved customer retention through loyalty program synchronization.

Why it matters: Omnichannel integration boosts sales, streamlines operations, and builds brand loyalty in an increasingly connected world.

8. Automated Regulatory Compliance Saves Time and Money

Keeping pace with tax laws, cross-border regulations, and financial reporting triggers is complex. Automated compliance tools monitor regulations continuously, generate accurate reports, and update systems proactively. In this process, having a reliable merchant of record like Cleeng ensures that transactions are handled correctly and compliance obligations are met.

- Machine-driven validation ensures all payment and invoicing data follow laws.

- Automatic tax calculation and remittance for multi-regional sales.

- Reduces fines, legal risks, and remediation costs.

- Supports GDPR, PCI DSS, CCPA, and other global regulations.

Why it matters: Compliance automation reduces overhead, protects businesses from penalties, and builds operational resilience.

9. Voice and IoT Payments Open New Channels

Emerging technologies allow consumers to pay via voice assistants (like Alexa or Google Home) and connected IoT devices (smart appliances or cars). While still nascent, these channels are growing in use and offer fresh opportunities for businesses.

- Users order and pay hands-free via voice commands.

- IoT-enabled devices can replenish supplies or services autonomously.

- New convenience channels reduce friction and increase engagement.

- Introduces novel cybersecurity considerations.

Why it matters: Early adopters tap into future customer behavior trends and position for new revenue streams.

10. Hyper-Personalized Payment Experiences Enhance Loyalty

AI-driven insights allow businesses to tailor payment options, offers, and communications to individual customer behaviors and preferences. Dynamic financing, timely reminders, and customized discounts create a more engaging merchant-customer relationship.

- Promotions and financing offers based on individual credit and purchase history.

- Intelligent reminders improve subscription renewals and reduce tardy payments.

- Payment options adapt dynamically to customer segments or geography.

- Personalization increases customer satisfaction and lifetime value.

Why it matters: Customized payment journeys reduce churn, boost revenue, and deepen customer connections.

Professionals building, integrating, or consulting on these payment technologies can showcase real projects and live demos on Fueler, a platform designed to highlight your expertise through portfolios. Demonstrating your skills with cutting-edge payment systems helps you stand out to clients and maximize hiring potential in a rapidly evolving payments landscape.

Final Thoughts

In 2026, payments are no longer just a back-office function they are a critical component of business strategy and customer experience. Real-time payments, AI-powered automation, mobile wallets, BNPL, blockchain, and personalized experiences are reshaping how businesses transact. Understanding and adopting these trends early will position your business for stronger growth, increased security, and better customer loyalty in a hyper-connected economy. Presenting your mastery of these trends through a strong portfolio on Fueler can unlock new career and business opportunities in this thriving sector.

FAQs

1. What are the most important payment trends in 2026 for businesses?

Key trends include real-time payments, AI automation, digital wallets, buy now pay later, blockchain, omnichannel integration, and enhanced payment security.

2. How do real-time payments benefit small and large businesses?

Real-time payments speed up cash flow, reduce payment delays, improve reconciliation, and increase vendor and customer satisfaction.

3. Why is AI important in payment processing and fraud prevention?

AI detects fraudulent behavior early, automates repetitive tasks, and ensures compliance, reducing losses and operational costs.

4. How does Buy Now, Pay Later (BNPL) impact business sales?

BNPL increases average order value and conversion rates by offering customers flexible payment options without upfront costs.

5. Can professionals showcase payment automation skills to get more business?

Yes, platforms like Fueler allow you to present real payment integration projects and demos to attract clients and employers looking for proven payment expertise.

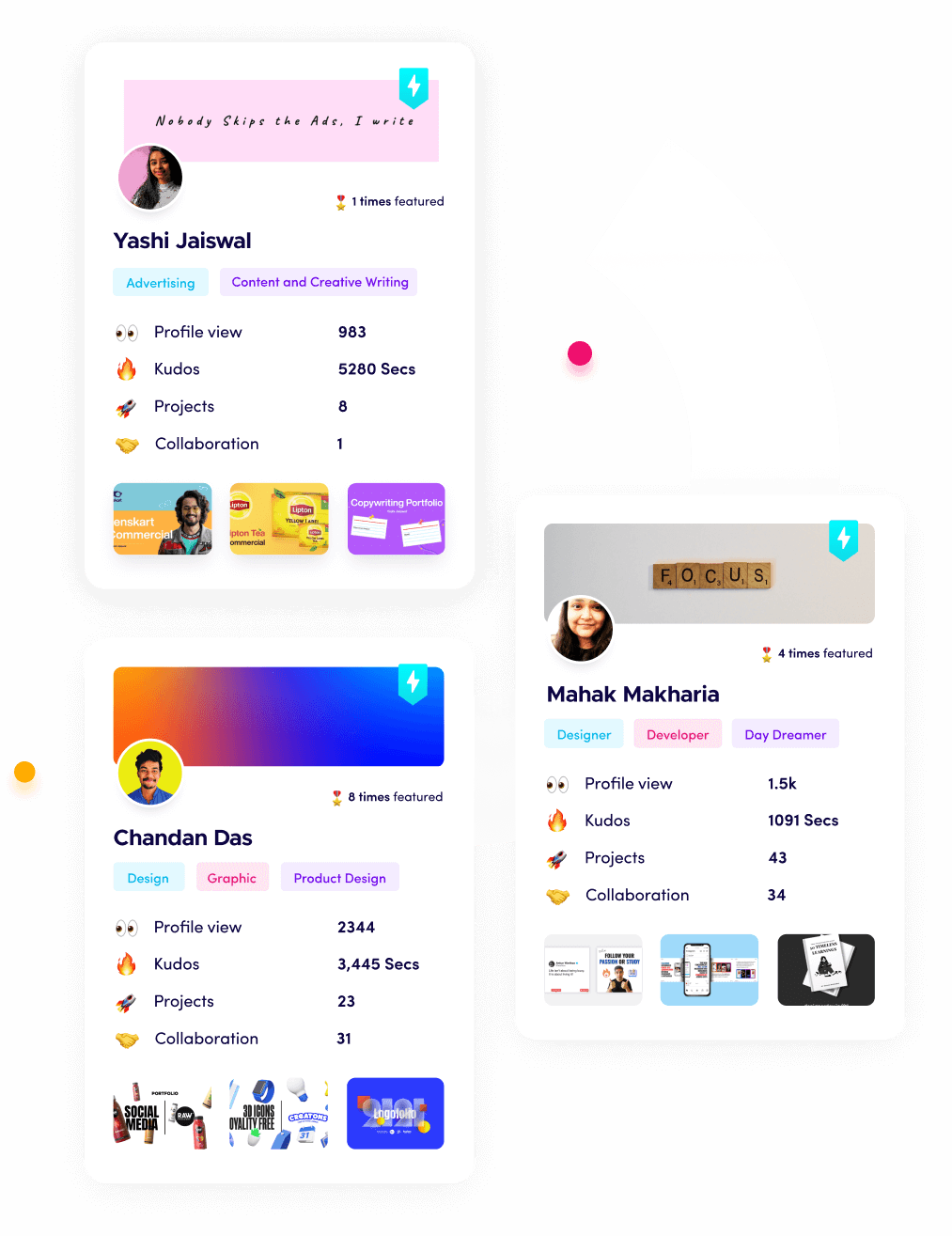

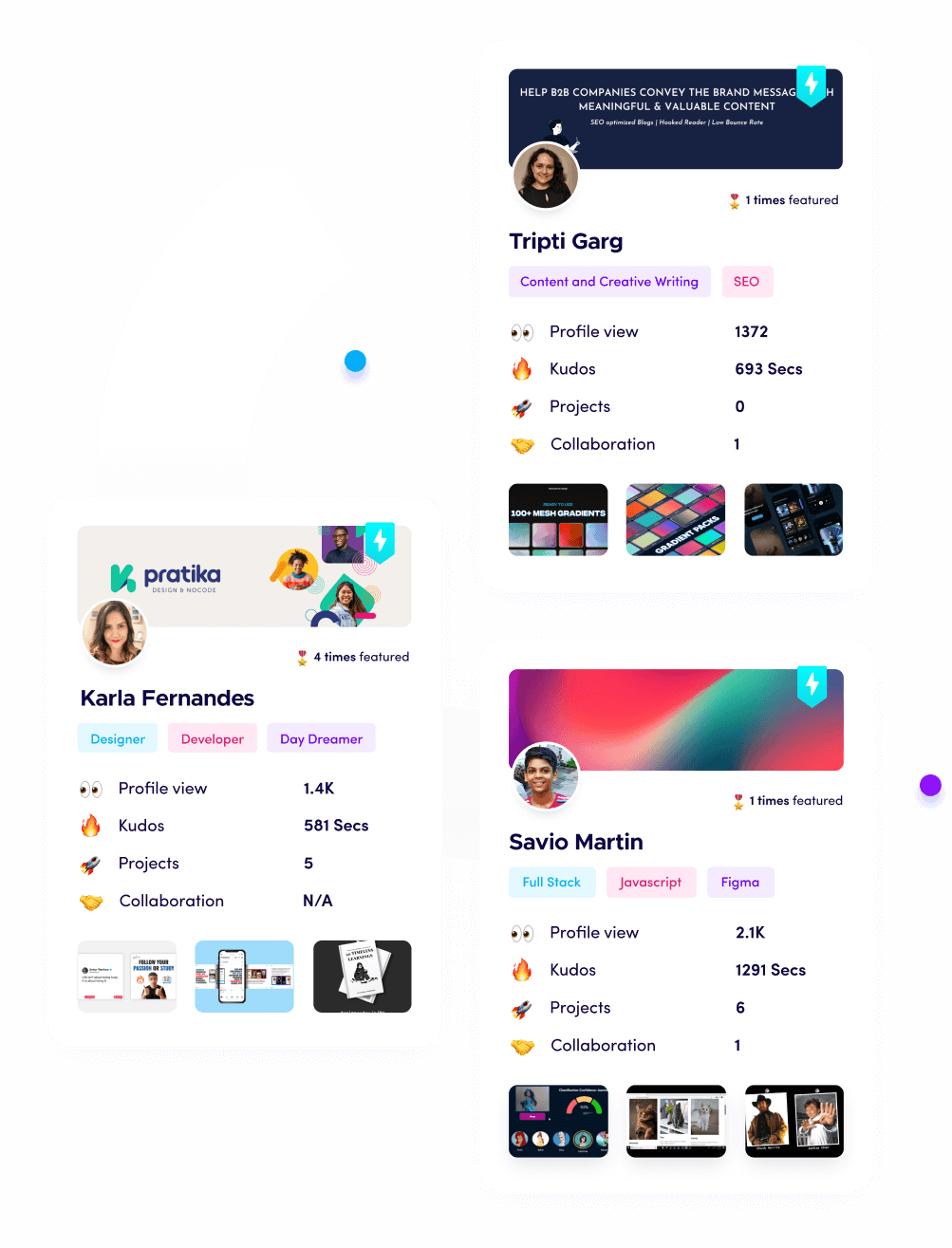

What is Fueler Portfolio?

Fueler is a career portfolio platform that helps companies find the best talents for their organization based on their proof of work. You can create your portfolio on Fueler, thousands of freelancers around the world use Fueler to create their professional-looking portfolios and become financially independent. Discover inspiration for your portfolio

Sign up for free on Fueler or get in touch to learn more.