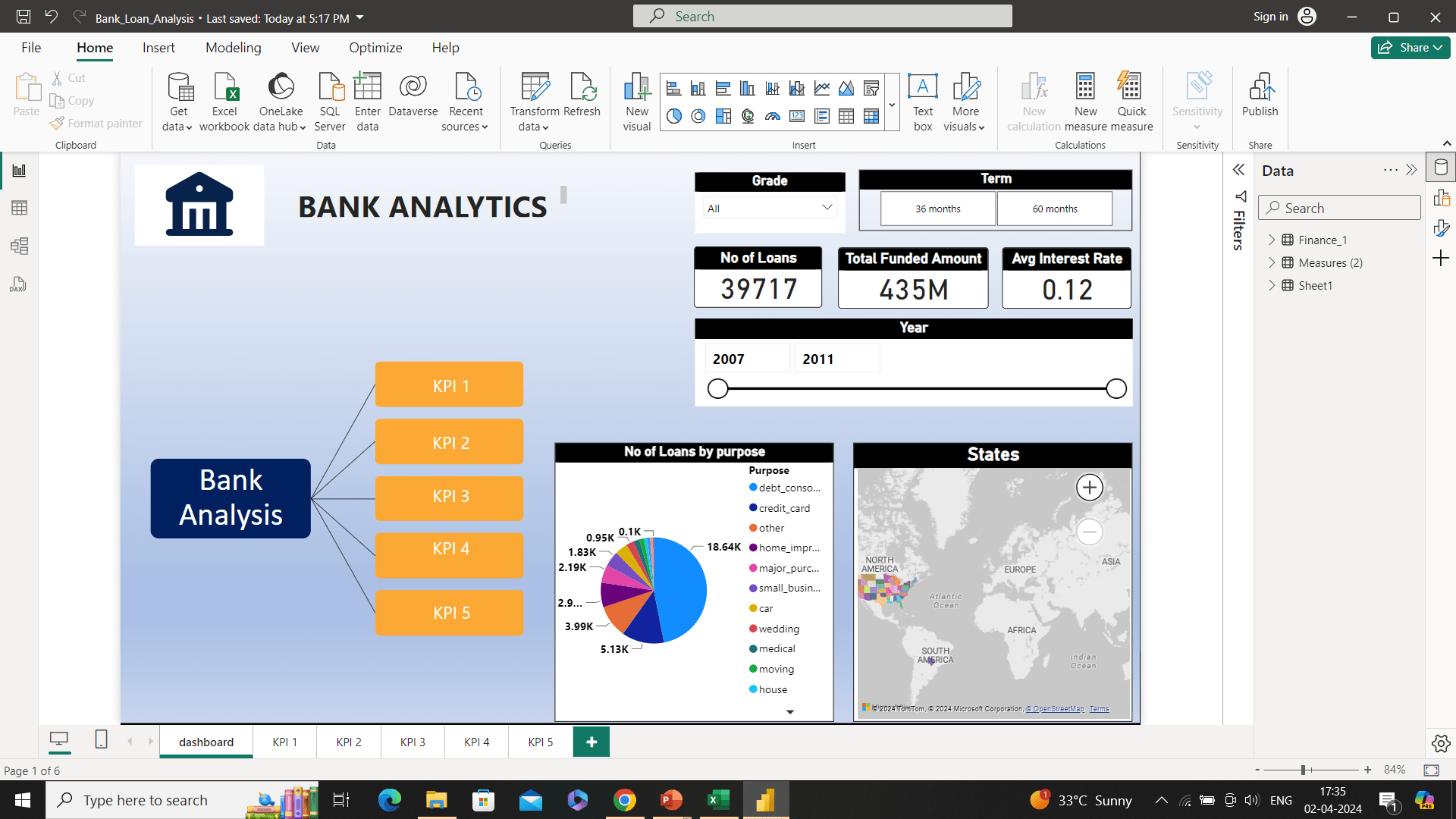

Bank Loan Analysis in Power BI

Bank loan customer analysis is the process banks use to assess the financial stability of individuals or businesses applying for loans. It involves evaluating income, credit history, debt-to-income ratio and assets to determine whether the applicant will repay the loan on time. While learning the cource in one of the institute I came across this project.

KPIs Analysed:

1. Year-wise loan amount Stats

2.Grade and sub-grade-wise revol_bal

3.Total Payment for Verified Status Vs Total Payment for Non-Verified Status

4. State-wise and month-wise loan status

5.Homeownership Vs last payment date stats

Tools used:-

Power BI Desktop

Dataset Details:-

• Domain: Finance(bank)

• Datasets given: Finance_1.xlsx & Finance_2.xlsx

• Dataset Type: Excel Data

• Dataset Size: Each Excel file has 39k+ records

03 Feb 2024